List Down the Benefits of Investing in Municipal Bonds for Income

Jan 25, 2024 By Susan Kelly

Introduction

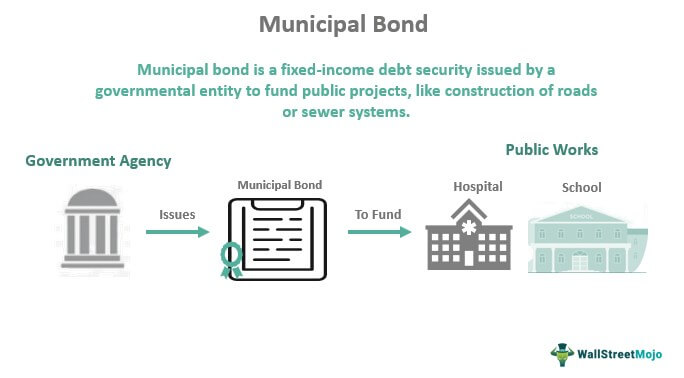

Diversifying your income can help you avoid tax implications and protect you from market volatility. One type of investment that can help you take advantage of tax savings is municipal bonds. These bonds provide attractive returns since the interest they pay is not subject to federal income tax. Furthermore, exemptions from state and local taxes may be available.

Municipal bonds are a form of debt security issued by local, state, and national governments. Investors in "muni" bonds receive back their initial investment plus interest payments throughout the bond's term. The interest received from municipal bonds is exempt from federal taxation. Municipal bonds issued by the investor's home state or municipality are not taxable at the state or local level, in addition to being exempt from federal income tax.

Types of Municipal Bonds

Municipal bonds can either be issued as general obligation bonds or revenue bonds. General obligation bonds can be used to finance public works projects that do not have a dedicated revenue stream. On the other hand, revenue bonds fund publicly funded projects that are expected to generate income. Both have their merits and pitfalls as investment options.

General Obligation Bonds

Public works projects that don't generate revenue but benefit the community can be financed with general obligation bonds. General obligation bonds are only backed by the issuer's full faith and credit without a specific asset that bondholders could reclaim. That's why G.O. bonds are considered a rather secure investment option.

Revenue Bonds

A toll road or a concert hall are two examples of income-generating projects that revenue bonds issued by municipalities could finance. Bondholders will be repaid from the project's proceeds. Since the funds are utilised for a specific project, which may or may not is finished on time, within budget, and may not generate the expected revenues, the default rates for revenue bonds are greater than those for general obligation bonds. You should check the issuer's creditworthiness before committing money to it.

Benefits of Municipal Bonds

There are several benefits to investing in municipal bonds.

Low Default Rates

Municipal bonds had an all-rated CDR of 0.08% from 1970 to 2020, whereas global corporate bonds had a CDR of 6.89% for the same period.

Tax-Free Interest

Compared to corporate bonds, the interest on municipal bonds is exempt from federal income tax, making them a more attractive investment alternative. Even though federal (and sometimes state) taxes lessen interest payments, the advertised interest rates paid by corporate bonds are often higher. However, municipal bonds are generally exempt from federal income taxation. The after-tax profit is used as a stand-in for the pre-tax profit.

Call Risk

Some municipal bonds allow the issuer to "call" the bond and repay the principal amount to the bondholder before the maturity date. If the issuer can save money by reissuing the bond or refinancing at a cheaper interest rate, they may exercise their right to call the bond.

Safety

Municipal bonds have a reputation for being one of the safest investment alternatives available among fixed-income securities. Generally, G.O. bonds are more secure than revenue bonds since municipalities can raise taxes to pay off debt. However, revenue bonds are based on the project's amount of money. If a project's revenues are lower than expected, the issuer of nonrecourse revenue bonds is not obligated to compensate for the difference.

Diversification

Instead of placing your money into one security, it's smart to diversify your holdings. Your portfolio's total risk is lowered as a result. Since muni bonds and other fixed-income securities share relative risk and return profiles, they are often utilised in tandem with Treasurys and corporate bonds. Generally speaking, the yield on municipal bonds is higher than that of Treasury bonds and lower than that of corporate bonds.

Conclusion

Municipal bonds are especially beneficial for wealthy investors in states with high state and local income taxes. If you live in a state that doesn't levy an income tax, you won't be able to buy municipal bonds issued by a tax-free state, but if you live in a state that does, you will. The benefits and downsides of municipal bonds are comparable to any other investment.

A wealth manager can advise you on whether or not investing in municipal bonds is a good idea in light of your financial situation. Due to their minimal default risk and preferential tax status, municipal bonds can be a worthwhile investment. It's important to remember that there is always some danger, no matter how small. Municipal default is possible but exceedingly improbable. There is always a chance of losing money when investing. It would help if you treated municipal bonds with the same degree of care you would any other investment.

Investment

What Is Par Value?

It's important to note that the nominal or "par" value listed in a company's charter is not the same as the actual face amount of a bond or shares

Learn More

Investment

Everything You Need To Know About Investing In The Dow Jones

Are you willing to know everything about stock marketing? Hit this article, as it is about how to invest in the Dow Jones efficiently

Learn More

Banking

Difference Between Money Market Fund, MMA, And Savings Accounts

You're possibly confused about what you should do with the money that you've already begun to save. The money market mutual fund, the money market account, often known as an MMA, and the traditional savings account are three of the most common choices.

Learn More

Taxes

Understanding Idaho Income Tax and Using the Calculator

Curious about your Idaho state taxes? Use our Idaho income tax calculator to quickly estimate your tax liability. Learn about Idaho tax rates and how to calculate your Idaho state tax.

Learn More

Banking

What Is the Income Effect: Exploring the Key Details

Interested in understanding the income effect? This article simplifies it for you, without all the fancy jargon. Learn how it shapes your spending habits and influences your decisions.

Learn More

Banking

Limits for ATM withdrawals

Your maximum ATM withdrawal amount is determined by the local credit union you bank with because each one has its own rules. However, the daily restrictions for ATM withdrawals often range between $300 to $1,000. There is no set daily ATM withdrawal limit; instead, this is decided by the credit union or bank.

Learn More